Halyk Info

Limits were introduced to provide additional protection for your funds against unauthorized actions by third parties.

At the same time, in Halyk app, you have the ability to set/cancel restrictions on certain transactions.

You can set/remove limits on your card in Halyk:

• click on the desired card

• in the “Limits” section, choose “Set Limits”/“Remove Restrictions”

At the same time, in Halyk app, you have the ability to set/cancel restrictions on certain transactions.

You can set/remove limits on your card in Halyk:

• click on the desired card

• in the “Limits” section, choose “Set Limits”/“Remove Restrictions”

• Transfer limit between your cards

• Transfer limit from card to card of any banks in the Republic of Kazakhstan

• Transfer limit from card to any foreign card

• Transfer limit to a card by mobile number

• Transfer limit from card to any Halyk ATM

• Transfer limit for “Transfer to third parties by recipient account number” (transfer to individuals and legal entities within the bank and to other banks by account number - IBAN)

• Transfer limit from card to current account

• Limit on the amount of deposit replenishment at Halyk

• Limit on the maximum cash withdrawal amount via ATMs in Kazakhstan and outside the Republic of Kazakhstan

Please see the limit amounts below in the separately designated questions.

• Transfer limit from card to card of any banks in the Republic of Kazakhstan

• Transfer limit from card to any foreign card

• Transfer limit to a card by mobile number

• Transfer limit from card to any Halyk ATM

• Transfer limit for “Transfer to third parties by recipient account number” (transfer to individuals and legal entities within the bank and to other banks by account number - IBAN)

• Transfer limit from card to current account

• Limit on the amount of deposit replenishment at Halyk

• Limit on the maximum cash withdrawal amount via ATMs in Kazakhstan and outside the Republic of Kazakhstan

Please see the limit amounts below in the separately designated questions.

To ensure additional protection of your funds from unauthorized actions by third parties, limits are set by default on the following payments and cash withdrawals on cards.

• Restrictions on the maximum cash withdrawal amount

• Restrictions on online transactions

• Restrictions on transactions at POS terminals

• Restrictions on transactions at chip-less ATM

• Restrictions on brokerage services

You can independently temporarily cancel/set limits in Halyk app.

• Restrictions on the maximum cash withdrawal amount

• Restrictions on online transactions

• Restrictions on transactions at POS terminals

• Restrictions on transactions at chip-less ATM

• Restrictions on brokerage services

You can independently temporarily cancel/set limits in Halyk app.

Increased transfer/operation limits in Halyk app are available to customers who completed full registration with Halyk, including setting up a trusted device and undergoing video identity verification.

Transfer between your Halyk accounts (subject to product limitations, excluding withdrawals from a deposit):

• Minimum transfer amount – KZT 50/USD 1/EUR 1

• Maximum transfer amount via a trusted device: up to USD 50,000 per day, USD 1 million per month

• Maximum transfer amount via a trusted device: up to USD 30,000 per day, USD 1 million per month.

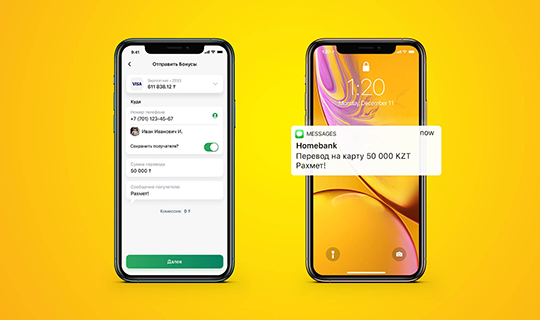

Transfer to Halyk Bank customer’s card via mobile phone number:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a Halyk Bank card to another Halyk Bank card:

• Minimum transfer amount – 50 KZT

• Maximum transfer amount via a trusted device: per transaction – 5,000 USD, per day – 10,000 USD, per month – 150,000 USD

• Maximum transfer amount via an untrusted device: per transaction – 750 USD, per day – 750 USD, per month – 10,000 USD

• Maximum number of transfers – 100 transfers per day.

Transfer from Halyk Bank card to a card from another bank:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a card/account to a 20-digit account:

• Maximum transfer amount to a third-party account at another bank via a trusted device: per transaction – USD 3,500, per day – USD 7,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

• Maximum transfer amount to a third-party account at Halyk Bank: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

Transfer from a card to any Halyk ATM (Cash by Code):

• Maximum withdrawal amount via a trusted device: per transaction – USD 750, per day – USD 2,500, per month – USD 10,000.

• Maximum withdrawal amount via an untrusted device: per transaction – USD 750/KZT 300,000, per day – USD 1,200/KZT 500,000, per month – USD 10,000/KZT 4,200,000.

• Minimum withdrawal amount: KZT 2,000 /equivalent in currency per day.

• The amount shoul dbe a multiple of KZT 1,000 (you cannot withdraw KZT 3,000).

Transfer from a card to a foreign card:

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day. QR Code Transfers:

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Western Union Transfers:

• Maximum transfer amount: per transaction – USD 2,500, per day – USD 10,000, per month – USD 25,000.

• Maximum number of transfers – 10 transfers per month.

Transfer between your Halyk accounts (subject to product limitations, excluding withdrawals from a deposit):

• Minimum transfer amount – KZT 50/USD 1/EUR 1

• Maximum transfer amount via a trusted device: up to USD 50,000 per day, USD 1 million per month

• Maximum transfer amount via a trusted device: up to USD 30,000 per day, USD 1 million per month.

Transfer to Halyk Bank customer’s card via mobile phone number:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a Halyk Bank card to another Halyk Bank card:

• Minimum transfer amount – 50 KZT

• Maximum transfer amount via a trusted device: per transaction – 5,000 USD, per day – 10,000 USD, per month – 150,000 USD

• Maximum transfer amount via an untrusted device: per transaction – 750 USD, per day – 750 USD, per month – 10,000 USD

• Maximum number of transfers – 100 transfers per day.

Transfer from Halyk Bank card to a card from another bank:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a card/account to a 20-digit account:

• Maximum transfer amount to a third-party account at another bank via a trusted device: per transaction – USD 3,500, per day – USD 7,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

• Maximum transfer amount to a third-party account at Halyk Bank: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

Transfer from a card to any Halyk ATM (Cash by Code):

• Maximum withdrawal amount via a trusted device: per transaction – USD 750, per day – USD 2,500, per month – USD 10,000.

• Maximum withdrawal amount via an untrusted device: per transaction – USD 750/KZT 300,000, per day – USD 1,200/KZT 500,000, per month – USD 10,000/KZT 4,200,000.

• Minimum withdrawal amount: KZT 2,000 /equivalent in currency per day.

• The amount shoul dbe a multiple of KZT 1,000 (you cannot withdraw KZT 3,000).

Transfer from a card to a foreign card:

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day. QR Code Transfers:

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Western Union Transfers:

• Maximum transfer amount: per transaction – USD 2,500, per day – USD 10,000, per month – USD 25,000.

• Maximum number of transfers – 10 transfers per month.

Transfer limits to a card by phone number to a Halyk Bank customer:

• minimum transfer amount - KZT 50

• maximum transfer amount via a trusted device: per transaction - USD 5,000, per day - USD 10,000, per month - USD 150,000

• maximum transfer amount via an untrusted device: per transaction - USD 750, per day - USD 750, per month - USD 10,000

• maximum number of transfers - 100 transfers per day.

Transfer limits to a card by phone number to a card of another bank in the Republic of Kazakhstan:

• minimum transfer amount - KZT 350

• maximum transfer amount via a trusted/untrusted device: per transaction/per day/per month - KZT 300,000

Increased transfer/transaction limits in the Halyk app are available to customers who have completed full registration with Halyk, installed a trusted device, and undergone video identity verification.

• minimum transfer amount - KZT 50

• maximum transfer amount via a trusted device: per transaction - USD 5,000, per day - USD 10,000, per month - USD 150,000

• maximum transfer amount via an untrusted device: per transaction - USD 750, per day - USD 750, per month - USD 10,000

• maximum number of transfers - 100 transfers per day.

Transfer limits to a card by phone number to a card of another bank in the Republic of Kazakhstan:

• minimum transfer amount - KZT 350

• maximum transfer amount via a trusted/untrusted device: per transaction/per day/per month - KZT 300,000

Increased transfer/transaction limits in the Halyk app are available to customers who have completed full registration with Halyk, installed a trusted device, and undergone video identity verification.

• Maximum withdrawal amount via a trusted device: per transaction – 750 USD, per day – USD 2,500, per month – USD 10,000.

• Maximum withdrawal amount via an untrusted device: per transaction – USD 750 / KZT 300,000, per day – USD 1,200 / KZT 500,000, per month – USD 10,000 / KZT 4,200,000.

• Minimum withdrawal amount: KZT 2,000 / equivalent in currency per day.

• The amount must be a multiple of KZT 1,000 (you cannot withdraw exactly 3,000).

• Maximum withdrawal amount via an untrusted device: per transaction – USD 750 / KZT 300,000, per day – USD 1,200 / KZT 500,000, per month – USD 10,000 / KZT 4,200,000.

• Minimum withdrawal amount: KZT 2,000 / equivalent in currency per day.

• The amount must be a multiple of KZT 1,000 (you cannot withdraw exactly 3,000).

Transfer limits from Halyk Bank card to Halyk Bank card:

• minimum transfer amount – KZT 50

• maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• maximum number of transfers – 100 transfers per day.

Transfer limits from a Halyk Bank card to another bank’s card:

• minimum transfer amount – KZT 50

• maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• maximum number of transfers – 100 transfers per day.

Restrictions on transfers from a card to a foreign card:

• maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• maximum number of transfers – 100 transfers per day.

Increased transfer/transaction limits in Halyk app are available to customers who completed full registration with Halyk, including setting up a trusted device and video identity verification.

• minimum transfer amount – KZT 50

• maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• maximum number of transfers – 100 transfers per day.

Transfer limits from a Halyk Bank card to another bank’s card:

• minimum transfer amount – KZT 50

• maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• maximum number of transfers – 100 transfers per day.

Restrictions on transfers from a card to a foreign card:

• maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• maximum number of transfers – 100 transfers per day.

Increased transfer/transaction limits in Halyk app are available to customers who completed full registration with Halyk, including setting up a trusted device and video identity verification.

The maximum amount of payments for mobile communication service from a trusted device is KZT 100,000 per month in favor of mobile operator, and from an untrusted device – KZT 20,000 per month in favor of mobile operator, regardless of the payment method, whether with bonuses or from the account.

Upon completing full registration in Halyk app, you will gain access to all Halyk Bank products and online services, including increased transfer/transaction limits within Halyk app. To do this:

1. Download the Halyk app from Play Market for Android or from the App Store for iOS (iPhone).

2. Open the app and click “Register”:

• Enter your phone number

• Enter the code received via SMS sent to your mobile number

• Enter your IIN and review the Terms and Conditions of the Privacy Policy

• Complete video identity verification according to the instructions

• Set a 4-digit access code for future app login

Done!

Registration with passport details is available on the Android platform starting from version 5.16.0.

1. Download the Halyk app from Play Market for Android or from the App Store for iOS (iPhone).

2. Open the app and click “Register”:

• Enter your phone number

• Enter the code received via SMS sent to your mobile number

• Enter your IIN and review the Terms and Conditions of the Privacy Policy

• Complete video identity verification according to the instructions

• Set a 4-digit access code for future app login

Done!

Registration with passport details is available on the Android platform starting from version 5.16.0.

Restrictions on transferring funds from a card to a current account:

• Minimum transfer amount: KZT 50/USD 1/EUR 1

Important! Transfers are unavailable for certain card and account types (they are highlighted in gray in the drop-down list).

Restrictions on transferring funds from a current account to a card:

• Minimum transfer amount: KZT 50/USD 1/EUR 1

Important! Transfers are unavailable for certain card and account types (they are highlighted in gray in the drop-down list).

• Minimum transfer amount: KZT 50/USD 1/EUR 1

Important! Transfers are unavailable for certain card and account types (they are highlighted in gray in the drop-down list).

Restrictions on transferring funds from a current account to a card:

• Minimum transfer amount: KZT 50/USD 1/EUR 1

Important! Transfers are unavailable for certain card and account types (they are highlighted in gray in the drop-down list).

You can remove restrictions on card payments and transactions in Halyk:

1. Log in to Halyk.

2. Choose the desired card.

3. Click “Remove Restrictions.”

4. In the dropdown list, choose the necessary option – “Online Transactions” / “POS Terminal Transactions” / “Chip-less ATM Transactions” / “Brokerage Services.”

5. Specify the number of days for which the restriction will be removed.

Done!

1. Log in to Halyk.

2. Choose the desired card.

3. Click “Remove Restrictions.”

4. In the dropdown list, choose the necessary option – “Online Transactions” / “POS Terminal Transactions” / “Chip-less ATM Transactions” / “Brokerage Services.”

5. Specify the number of days for which the restriction will be removed.

Done!

The daily cash withdrawal limit via ATM of banks in Kazakhstan is KZT 700,000 (seven hundred thousand tenge) or the equivalent in another currency. This amount can be increased to KZT 3,000,000 in Halyk app.

To withdraw amount exceeding KZT 3,000,000, please visit a bank outlet.

The daily cash withdrawal limit via ATM of banks outside the Republic of Kazakhstan is USD 2,000 (two thousand) or the equivalent in another currency. This amount can be increased to USD 25,000 in Halyk app. Foreign banks may also set their own limits on cash withdrawals via their ATMs.

To withdraw amount exceeding KZT 3,000,000, please visit a bank outlet.

The daily cash withdrawal limit via ATM of banks outside the Republic of Kazakhstan is USD 2,000 (two thousand) or the equivalent in another currency. This amount can be increased to USD 25,000 in Halyk app. Foreign banks may also set their own limits on cash withdrawals via their ATMs.

You can remove the cash withdrawal limit via Halyk ATM as follows:

1. Log in to Halyk

2. Choose the desired card

3. Click “Remove Limit”

4. Choose “To Max. Withdrawal Amount” from the dropdown list

5. Specify the number of days for which the limit will be removed

Done! You can withdraw more than KZT 700,000 per day, but no more than KZT 3,000,000 (or the equivalent in another currency).

To withdraw an amount exceeding KZT 3,000,000, please visit a Bank outlet.

1. Log in to Halyk

2. Choose the desired card

3. Click “Remove Limit”

4. Choose “To Max. Withdrawal Amount” from the dropdown list

5. Specify the number of days for which the limit will be removed

Done! You can withdraw more than KZT 700,000 per day, but no more than KZT 3,000,000 (or the equivalent in another currency).

To withdraw an amount exceeding KZT 3,000,000, please visit a Bank outlet.

You can set card limits in Halyk:

• click on the desired card

• in the “Limits” section, choose “Set Limits”

• click on the desired card

• in the “Limits” section, choose “Set Limits”

Yes, Halyk has limits on transfer amounts. When making a transfer online, the system will inform you of the limits for each transfer.

Via the contact center, you can change your limits (call from your mobile to 7111):

• on cash withdrawals at ATMs

• on transactions at POS terminals

• on cash withdrawals at ATMs

• on transactions at POS terminals