Halyk Info

Halyk app is available to customers in three languages: Kazakh, Russian, and English. The app settings allow the customer to choose their preferred language:

• On Halyk app login screen

• In the upper right corner, tap the Menu icon (3 lines)

• Choose “Settings,” then “Language,” and choose the app language

For some Android mobile devices, the language displayed in Halyk app depends on the language setting of the mobile device. That is, if the mobile device settings are in Kazakh, Halyk app will also be available in Kazakh. For iOS devices, simply change the language within the Bank app.

• On Halyk app login screen

• In the upper right corner, tap the Menu icon (3 lines)

• Choose “Settings,” then “Language,” and choose the app language

For some Android mobile devices, the language displayed in Halyk app depends on the language setting of the mobile device. That is, if the mobile device settings are in Kazakh, Halyk app will also be available in Kazakh. For iOS devices, simply change the language within the Bank app.

Terms and conditions for transferring money via mobile phone number:

• The transfer is sent to the Halyk Bank customer’s mobile phone number, and the funds will be credited to the recipient’s primary Halyk card.

• The primary card – chosen independently on the Home and is the card for receiving transfers via mobile phone number. By default, the primary card is the most active one.

Transfers between Halyk Bank cards are fee-free.

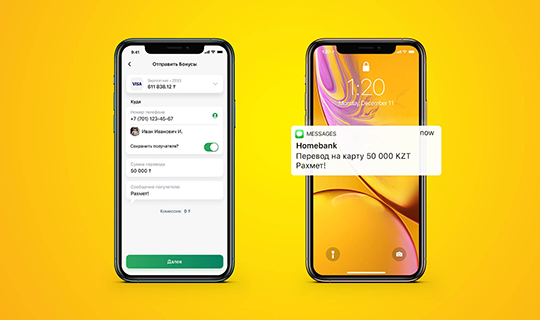

• In Halyk, on the Home, tap “Transfers,” then choose “By phone number.”

• Enter the recipient’s mobile phone number or choose from your address book.

• Enter the transfer amount and make the transfer.

Done! You will receive a notification about the debit, and the money will be credited to the recipient’s account. You can also reply to the notification received from the sender.

Tips:

1) If you frequently transfer money to the same people, you can save the recipient to your list so you don’t have to search for the phone number in your address book.

To do this, after the transfer, be sure to check “Save recipient,” and you won’t need to enter the phone number again.

2) You can also view the transfer you made in the “History” tab, display the receipt on the screen, repeat the transfer, or share it.

• The transfer is sent to the Halyk Bank customer’s mobile phone number, and the funds will be credited to the recipient’s primary Halyk card.

• The primary card – chosen independently on the Home and is the card for receiving transfers via mobile phone number. By default, the primary card is the most active one.

Transfers between Halyk Bank cards are fee-free.

• In Halyk, on the Home, tap “Transfers,” then choose “By phone number.”

• Enter the recipient’s mobile phone number or choose from your address book.

• Enter the transfer amount and make the transfer.

Done! You will receive a notification about the debit, and the money will be credited to the recipient’s account. You can also reply to the notification received from the sender.

Tips:

1) If you frequently transfer money to the same people, you can save the recipient to your list so you don’t have to search for the phone number in your address book.

To do this, after the transfer, be sure to check “Save recipient,” and you won’t need to enter the phone number again.

2) You can also view the transfer you made in the “History” tab, display the receipt on the screen, repeat the transfer, or share it.

Increased transfer/transaction limits in Halyk app are available to customers who completed full registration with Halyk, including setting up a trusted device and passing video verification.

Transfer between your Halyk accounts (subject to product limitations, excluding withdrawals from a deposit):

• Minimum transfer amount – KZT 50/USD 1/EUR 1

• Maximum transfer amount via a trusted device: up to USD 50,000 per day, USD 1 million per month

• Maximum transfer amount via a trusted device: up to USD 30,000 per day, USD 1 million per month.

Transfer to a Halyk Bank customer’s card via mobile number:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a Halyk Bank card to another Halyk Bank card:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a Halyk Bank card to a card from another bank:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a card/account to a 20-digit account:

• Maximum transfer amount to a third-party account in another bank via a trusted device: per transaction – USD 3,500, per day – USD 7,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

• Maximum transfer amount to a third-party account in Halyk Bank: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

Transfer from a card to any Halyk ATM (Cash by Code):

• Maximum withdrawal amount via a trusted device: per transaction – USD 750, per day – USD 2,500, per month – USD 10,000.

• Maximum withdrawal amount via an untrusted device: per transaction – USD 750/KZT 300,000, per day – USD 1,200/KZT 500,000, per month – USD 10,000/KZT 4,200,000.

• Minimum withdrawal amount: KZT 2,000/equivalent in currency per day.

• The amount should be a multiple of KZT 1,000 (you cannot withdraw KZT 3,000).

Transfer from a card to a foreign card:

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – 750 USD, per day – 750 USD, per month – 10,000 USD

• Maximum number of transfers – 100 transfers per day. QR Code Transfers:

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Western Union Transfers:

• Maximum transfer amount: per transaction – USD 2,500, per day – USD 10,000, per month – USD 25,000.

• Maximum number of transfers – 10 transfers per month.

Transfer between your Halyk accounts (subject to product limitations, excluding withdrawals from a deposit):

• Minimum transfer amount – KZT 50/USD 1/EUR 1

• Maximum transfer amount via a trusted device: up to USD 50,000 per day, USD 1 million per month

• Maximum transfer amount via a trusted device: up to USD 30,000 per day, USD 1 million per month.

Transfer to a Halyk Bank customer’s card via mobile number:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a Halyk Bank card to another Halyk Bank card:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a Halyk Bank card to a card from another bank:

• Minimum transfer amount – KZT 50

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Transfer from a card/account to a 20-digit account:

• Maximum transfer amount to a third-party account in another bank via a trusted device: per transaction – USD 3,500, per day – USD 7,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

• Maximum transfer amount to a third-party account in Halyk Bank: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000 (via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000)

Transfer from a card to any Halyk ATM (Cash by Code):

• Maximum withdrawal amount via a trusted device: per transaction – USD 750, per day – USD 2,500, per month – USD 10,000.

• Maximum withdrawal amount via an untrusted device: per transaction – USD 750/KZT 300,000, per day – USD 1,200/KZT 500,000, per month – USD 10,000/KZT 4,200,000.

• Minimum withdrawal amount: KZT 2,000/equivalent in currency per day.

• The amount should be a multiple of KZT 1,000 (you cannot withdraw KZT 3,000).

Transfer from a card to a foreign card:

• Maximum transfer amount via a trusted device: per transaction – USD 2,500, per day – USD 5,000, per month – USD 150,000.

• Maximum transfer amount via an untrusted device: per transaction – 750 USD, per day – 750 USD, per month – 10,000 USD

• Maximum number of transfers – 100 transfers per day. QR Code Transfers:

• Maximum transfer amount via a trusted device: per transaction – USD 5,000, per day – USD 10,000, per month – USD 150,000

• Maximum transfer amount via an untrusted device: per transaction – USD 750, per day – USD 750, per month – USD 10,000

• Maximum number of transfers – 100 transfers per day.

Western Union Transfers:

• Maximum transfer amount: per transaction – USD 2,500, per day – USD 10,000, per month – USD 25,000.

• Maximum number of transfers – 10 transfers per month.

Registration in Halyk app.

1. Download Halyk app from Play Market for Android or from the App Store for iOS (iPhone).

2. Open the app and click “Login/Registration”:

• Enter the code received via SMS sent to your mobile number.

• Enter your IIN and read the Terms and Conditions of the Privacy Policy.

• Pass video iverification according to the instructions.

• Set a 4-digit code for future app logins.

Done! Enjoy all the benefits of Halyk 24/7 worldwide.

Registration in Halyk is temporarily unavailable for customers without an identity document (ID card, Residence Permit for a Foreign Citizen in the Republic of Kazakhstan, passport of the Republic of Kazakhstan).

Registration with passport details is available on the Android platform starting from version 5.16.0.

Registration in Halyk via Halyk Bank ATMs:

• Insert your card into the ATM and enter your PIN code.

• Choose the “Halyk Registration | SMS Banking” section.

• Click “Halyk Registration”.

• Enter your phone number; this number will become your trusted number.

• You will receive SMS with a code to your trusted number.

• Enter the code received via SMS into the ATM.

• You will receive SMS with a temporary password to log in to Halyk on your trusted number.

IMPORTANT! The temporary password is valid for 48 hours.

1. Download Halyk app from Play Market for Android or from the App Store for iOS (iPhone).

2. Open the app and click “Login/Registration”:

• Enter the code received via SMS sent to your mobile number.

• Enter your IIN and read the Terms and Conditions of the Privacy Policy.

• Pass video iverification according to the instructions.

• Set a 4-digit code for future app logins.

Done! Enjoy all the benefits of Halyk 24/7 worldwide.

Registration in Halyk is temporarily unavailable for customers without an identity document (ID card, Residence Permit for a Foreign Citizen in the Republic of Kazakhstan, passport of the Republic of Kazakhstan).

Registration with passport details is available on the Android platform starting from version 5.16.0.

Registration in Halyk via Halyk Bank ATMs:

• Insert your card into the ATM and enter your PIN code.

• Choose the “Halyk Registration | SMS Banking” section.

• Click “Halyk Registration”.

• Enter your phone number; this number will become your trusted number.

• You will receive SMS with a code to your trusted number.

• Enter the code received via SMS into the ATM.

• You will receive SMS with a temporary password to log in to Halyk on your trusted number.

IMPORTANT! The temporary password is valid for 48 hours.

1. Exchange transactions on purchase/sale of foreign currency cash are available at the outlet*.

* Attention! Sale of foreign currency (USD, EUR, CHF, GBP) to citizens of the Russian Federation and the Republic of Belarus is possible in case of residence permit for a foreign citizen in the Republic of Kazakhstan.

2. Transfers with FX conversion are available and operate in regular mode, including simultaneous conversion (if there are such terms and conditions for the type of transfer).

Transfers in KZT via Halyk app are available in regular mode, including with FX conversion (except for cards issued by Russian banks, and transfers to VTB Kazakhstan are suspended from 08.04.2022).

3. Deposit transactions with FX conversion are available.

When making a transaction, the current non-cash conversion rate at the time of the transaction will be applied.

The non-cash FX rate for card transactions is set by the Bank on a daily basis and is available on the Bank's website at www.halykbank.kz.

* Attention! Sale of foreign currency (USD, EUR, CHF, GBP) to citizens of the Russian Federation and the Republic of Belarus is possible in case of residence permit for a foreign citizen in the Republic of Kazakhstan.

2. Transfers with FX conversion are available and operate in regular mode, including simultaneous conversion (if there are such terms and conditions for the type of transfer).

Transfers in KZT via Halyk app are available in regular mode, including with FX conversion (except for cards issued by Russian banks, and transfers to VTB Kazakhstan are suspended from 08.04.2022).

3. Deposit transactions with FX conversion are available.

When making a transaction, the current non-cash conversion rate at the time of the transaction will be applied.

The non-cash FX rate for card transactions is set by the Bank on a daily basis and is available on the Bank's website at www.halykbank.kz.

You can apply for a loan on the Bank’s website, online in Halyk, or by visiting the nearest bank outlet.

To obtain a loan, you will need an ID card.

To obtain online loan, you should have Halyk Bank card and obtain a loan in 3 steps:

1. Download Halyk app

2. Register in Halyk

3. Obtain online loan in 5 minutes anywhere in the world, 7 days a week

If you do not have a card, you can order a card in Halyk app with free delivery or get it instantly at outlet.

The free Halyk app for Halyk Bank customers can be downloaded from the Apple Store and Play Market.

To obtain a loan, you will need an ID card.

To obtain online loan, you should have Halyk Bank card and obtain a loan in 3 steps:

1. Download Halyk app

2. Register in Halyk

3. Obtain online loan in 5 minutes anywhere in the world, 7 days a week

If you do not have a card, you can order a card in Halyk app with free delivery or get it instantly at outlet.

The free Halyk app for Halyk Bank customers can be downloaded from the Apple Store and Play Market.

Yes, we are pleased to announce the implementation of a new “Digital Documents” service at Halyk Bank. This service provides the ability to serve customers based on a digital identity document, without requiring the original ID card.

How to obtain a digital document:

1. Open eGov app

2. In the “Services” section, click on “Digital Documents”

3. You can log in in 2 ways:

• by entering your Electronic Digital Signature (EDS) password, or

• via SMS (after entering your IIN and phone number, a 5-digit code will be sent to your phone number)

4. Choose “Identity Document” from the document section and click on the “Allow Access to Document”

5. Dictate the short code displayed on the screen to the manager

Digital documents can be used in the following cases:

1) Issuing and reissuing cards;

2) Opening accounts and deposits;

3) Account statements, notifications about 20-digit accounts;

4) Changing data

The following operations are strictly prohibited using digital documents:

1) Applying for loans, credit cards;

2) Registering in the bank app;

3) Processing transfers/standing orders to third-party accounts;

4) All types of debit transactions from customer accounts.

How to obtain a digital document:

1. Open eGov app

2. In the “Services” section, click on “Digital Documents”

3. You can log in in 2 ways:

• by entering your Electronic Digital Signature (EDS) password, or

• via SMS (after entering your IIN and phone number, a 5-digit code will be sent to your phone number)

4. Choose “Identity Document” from the document section and click on the “Allow Access to Document”

5. Dictate the short code displayed on the screen to the manager

Digital documents can be used in the following cases:

1) Issuing and reissuing cards;

2) Opening accounts and deposits;

3) Account statements, notifications about 20-digit accounts;

4) Changing data

The following operations are strictly prohibited using digital documents:

1) Applying for loans, credit cards;

2) Registering in the bank app;

3) Processing transfers/standing orders to third-party accounts;

4) All types of debit transactions from customer accounts.

If you need a card urgently, you can re-issue your Halyk card within 5 minutes at any outlet of the bank, on the same service terms and conditions, and start using it immediately, the funds on your card will be available.

You can easily set PIN code in Halyk app: choose the desired card, go to PIN code - Set/change PIN code

Important! To activate a new PIN code, insert the card into any Halyk ATM, and conduct any transaction at the ATM.

You can also wait for your retained card to be delivered to a bank outlet:

• Within 5 business days, you will receive SMS with the address of the outlet where you can pick up your card. The list of retained card delivery outlets in your city are available at the link below.

• Until you receive your card, you can continue to use your card, having previously removed the temporary blocking in Halyk app: choose the card you forgot at the ATM, in the “Settings” section disable the “Temporary blocking” option.

You can also remove the blocking by contacting the Call Center at 7111.

Once the card is unblocked and until you receive it, you can perform all transactions:

- Add the card to Apple Pay, Google Pay, Samsung Pay, and pay with your smartphone.

For instructions on how to set up contactless payments, please refer to the dedicated sections.

- Pay for mobile communication, Internet, cable TV, utilities, and more than 6,000 other services in Halyk app without any fees.

- Make transfers to any card and by phone number in Halyk

- Withdraw cash from Halyk ATMs without a card

In case you forgot your card in the ATM of another bank: contact the call center of the bank where you forgot your card.

Map of outlets

You can easily set PIN code in Halyk app: choose the desired card, go to PIN code - Set/change PIN code

Important! To activate a new PIN code, insert the card into any Halyk ATM, and conduct any transaction at the ATM.

You can also wait for your retained card to be delivered to a bank outlet:

• Within 5 business days, you will receive SMS with the address of the outlet where you can pick up your card. The list of retained card delivery outlets in your city are available at the link below.

• Until you receive your card, you can continue to use your card, having previously removed the temporary blocking in Halyk app: choose the card you forgot at the ATM, in the “Settings” section disable the “Temporary blocking” option.

You can also remove the blocking by contacting the Call Center at 7111.

Once the card is unblocked and until you receive it, you can perform all transactions:

- Add the card to Apple Pay, Google Pay, Samsung Pay, and pay with your smartphone.

For instructions on how to set up contactless payments, please refer to the dedicated sections.

- Pay for mobile communication, Internet, cable TV, utilities, and more than 6,000 other services in Halyk app without any fees.

- Make transfers to any card and by phone number in Halyk

- Withdraw cash from Halyk ATMs without a card

In case you forgot your card in the ATM of another bank: contact the call center of the bank where you forgot your card.

Map of outlets

Да, рады сообщить, что в Halyk Bank внедряется новый сервис «Цифровые документы». Данный сервис предоставляет возможность обслуживать клиентов на основании цифрового документа, удостоверяющего личность, не требуя оригинала удостоверения личности.

Как получить цифровой документ:

1. Открыть приложение eGov mobile

2. В разделе «Сервисы» нажать на «Цифровые документы»

3. Пройти авторизацию можно 2 путями:

• через набор ЭЦП пароля, либо

• через SMS (после набора ИИН и ввода номера телефона клиента, на номер телефона отправляется 5-ти значный код)

4. Выбрать из раздела документов «Удостоверение личности» и нажать на кнопку «Открыть доступ к документу»

5. Продиктовать менеджеру короткий код, который отразится на экране

Цифровые документы можно использовать в следующих случаях:

1) Выпуск, перевыпуск карты;

2) Открытие счета и депозитов;

3) Справка о наличии счета, уведомления о 20-ти значных счетах;

4) Изменение данных

Категорически запрещено осуществлять следующие операции с использованием цифровых документов:

1) Оформление кредитов, кредитных карт;

2) Регистрироваться в приложении банка;

3) Оформлять переводы/длительные поручения на счета 3-х лиц;

4) Все виды расходных операций со счетов клиентов.

Как получить цифровой документ:

1. Открыть приложение eGov mobile

2. В разделе «Сервисы» нажать на «Цифровые документы»

3. Пройти авторизацию можно 2 путями:

• через набор ЭЦП пароля, либо

• через SMS (после набора ИИН и ввода номера телефона клиента, на номер телефона отправляется 5-ти значный код)

4. Выбрать из раздела документов «Удостоверение личности» и нажать на кнопку «Открыть доступ к документу»

5. Продиктовать менеджеру короткий код, который отразится на экране

Цифровые документы можно использовать в следующих случаях:

1) Выпуск, перевыпуск карты;

2) Открытие счета и депозитов;

3) Справка о наличии счета, уведомления о 20-ти значных счетах;

4) Изменение данных

Категорически запрещено осуществлять следующие операции с использованием цифровых документов:

1) Оформление кредитов, кредитных карт;

2) Регистрироваться в приложении банка;

3) Оформлять переводы/длительные поручения на счета 3-х лиц;

4) Все виды расходных операций со счетов клиентов.

В целях дополнительной защиты Ваших средств от противоправных действий третьих лиц, на все карты Halyk Bank по умолчанию установлены лимиты на максимальные/минимальные суммы проведения определенных операций, которые Вы можете самостоятельно временно отменить/установить в Halyk.

Повышенные размеры лимитов по переводам/ операциям в приложении Halyk доступны для клиентов, прошедшим полную регистрацию в Halyk с установкой доверенного устройства и видео-подтверждением личности.

Ограничения на перевод между своими счетами в Halyk (в зависимости от ограничений по продукту, за исключением изъятия с депозита):

• минимальная сумма перевода - 50 KZT/1 USD/1 EUR

• максимальная сумма перевода через доверенное устройство: в сутки до 50 000 USD, в месяц - 1 млн USD

• максимальная сумма перевода через доверенное устройство: в сутки до 30 000 USD, в месяц - 1 млн USD.

Лимит на перевод на карту по мобильному номеру клиенту Halyk Bank:

• минимальная сумма перевода - 50 KZT

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Лимит на перевод с карты Halyk Bank на карту Halyk Bank:

• минимальная сумма перевода - 50 KZT

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Лимит на перевод с карты Halyk Bank на карту другого банка:

• минимальная сумма перевода - 50 KZT

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 2 500 USD, в сутки - 5 000 USD, в месяц - 150 000 USD.

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Ограничения на перевод с карты/со счета на 20-ти значный счет:

• максимальная сумма перевода на счет третьего лица в другом банке через доверенное устройство: за 1 операцию - 3 500 USD, в сутки - 7 000 USD, в месяц - 150 000 USD (через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD)

• максимальная сумма перевода на счет третьего лица в Halyk Bank: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD (через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD)

Лимит на перевод с карты на любой банкомат сети Halyk (Cash by Code):

• максимальная сумма снятия через доверенное устройство: за 1 операцию - 750 USD, в сутки - 2 500 USD, в месяц - 10 000 USD.

• максимальная сумма снятия через недоверенное устройство: за 1 операцию - 750 USD/ 300 000 KZT, в сутки - 1 200 USD/ 500 000 KZT, в месяц - 10 000 USD/ 4 200 000 KZT.

• минимальная сумма снятия: 2 000 тенге/ эквивалент в валюте в сутки.

• сумма должна быть кратна 1 000 тенге (только сумму 3000 снять нельзя)

Лимит на переводы с карты на зарубежную карту:

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 2 500 USD, в сутки - 5 000 USD, в месяц - 150 000 USD.

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Переводы на QR-код:

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Перевод Western Union:

• максимальная сумма перевода: за 1 операцию - 2500 USD, в сутки - 10 000 USD, в месяц - 25 000 USD.

• максимальное количество переводов - 10 переводов в месяц.

Повышенные размеры лимитов по переводам/ операциям в приложении Halyk доступны для клиентов, прошедшим полную регистрацию в Halyk с установкой доверенного устройства и видео-подтверждением личности.

Ограничения на перевод между своими счетами в Halyk (в зависимости от ограничений по продукту, за исключением изъятия с депозита):

• минимальная сумма перевода - 50 KZT/1 USD/1 EUR

• максимальная сумма перевода через доверенное устройство: в сутки до 50 000 USD, в месяц - 1 млн USD

• максимальная сумма перевода через доверенное устройство: в сутки до 30 000 USD, в месяц - 1 млн USD.

Лимит на перевод на карту по мобильному номеру клиенту Halyk Bank:

• минимальная сумма перевода - 50 KZT

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Лимит на перевод с карты Halyk Bank на карту Halyk Bank:

• минимальная сумма перевода - 50 KZT

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Лимит на перевод с карты Halyk Bank на карту другого банка:

• минимальная сумма перевода - 50 KZT

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 2 500 USD, в сутки - 5 000 USD, в месяц - 150 000 USD.

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Ограничения на перевод с карты/со счета на 20-ти значный счет:

• максимальная сумма перевода на счет третьего лица в другом банке через доверенное устройство: за 1 операцию - 3 500 USD, в сутки - 7 000 USD, в месяц - 150 000 USD (через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD)

• максимальная сумма перевода на счет третьего лица в Halyk Bank: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD (через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD)

Лимит на перевод с карты на любой банкомат сети Halyk (Cash by Code):

• максимальная сумма снятия через доверенное устройство: за 1 операцию - 750 USD, в сутки - 2 500 USD, в месяц - 10 000 USD.

• максимальная сумма снятия через недоверенное устройство: за 1 операцию - 750 USD/ 300 000 KZT, в сутки - 1 200 USD/ 500 000 KZT, в месяц - 10 000 USD/ 4 200 000 KZT.

• минимальная сумма снятия: 2 000 тенге/ эквивалент в валюте в сутки.

• сумма должна быть кратна 1 000 тенге (только сумму 3000 снять нельзя)

Лимит на переводы с карты на зарубежную карту:

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 2 500 USD, в сутки - 5 000 USD, в месяц - 150 000 USD.

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Переводы на QR-код:

• максимальная сумма перевода через доверенное устройство: за 1 операцию - 5 000 USD, в сутки - 10 000 USD, в месяц - 150 000 USD

• максимальная сумма перевода через недоверенное устройство: за 1 операцию - 750 USD, в сутки - 750 USD, в месяц - 10 000 USD

• максимальное количество переводов - 100 переводов в сутки.

Перевод Western Union:

• максимальная сумма перевода: за 1 операцию - 2500 USD, в сутки - 10 000 USD, в месяц - 25 000 USD.

• максимальное количество переводов - 10 переводов в месяц.