Air Astana tickets on credit

Benefits

Buying terms

| Loan term (months) | 1, 3, 6, 12, 24, 36, 48, 60 |

| Amount | from 4,000 to 6,000,000 tenge |

| Fees | no |

| Partial early repayment | at least 3 payments: |

| Full early repayment | - in the Halyk application without fees |

| Interest rate | 33% to 38% (AEIR of 36,3% to 45.3%) |

The borrower (an individual) shall be liable for non-fulfillment of obligations under the bank loan agreement.

In case the borrower fails to fulfill its obligations under the bank loan agreement, the Bank shall be entitled to, without limitation:

- accruе forfeit (fine, penalty);

- foreclose on the money in the borrower's bank accounts;

- transfer the debt to a collection agency for pre-trial collection and settlement;

- file a lawsuit in court

Apply for a loan to cover the cost of a flight, in a matter of minutes

1. You can book your flight:

- on www.airastana.com

- using AirAstana mobile app

2. Get the order number*. For further registration of your application go to the Halyk in one of the following ways:

- through the specified link on the website / Air Asatana mobile app

- open the Halyk** on your own, on the main page select “Installment plan”, next from the list of partners select “Air Astana”

3. Enter your order number in the "Enter order number" field

4. Check the booking details, select the loan term and click "Next"

5. Make aware yourself of a loan documentation and sign the documents using the EDS issued by the Bank

6. Once loan is approved, your e-Ticket will be sent to your email address

Done!

* the booking is valid within 1 hour from the moment of receiving the booking number

* to apply for a loan, you must go through an online registration at Halyk with video verification of your identity without visiting the branch

How to check my loan debt?

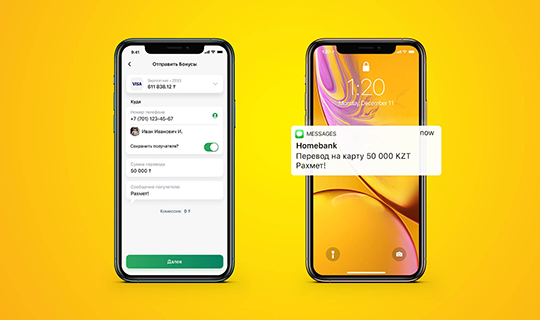

Information on debt and repayment schedule is available in the Halyk application

- Outstanding amount: “Accounts”, - “Loans”

- Repayment schedule: when you click on loan, information is available with the corresponding statuses

How to repay loan?

Pay the loan in the Halyk App on time, or before the scheduled date, to avoid delinquency and not to affect your credit history. You need to:

- Open Halyk

- Click “Repay loan” on the home screen

- Select a loan you want to make the payment on

- Select a card or account for payment and enter the payment amount

- Confirm the payment

Please note! Loan repayment in the Halyk App is available from 09:00 to 18:00

How to recharge Halyk account or card to repay loan?

- from Halyk Bank account or card in Halyk at no charge

- from another bank card

- at Cash-In ATMs

- in payment terminals

- at branch cashie

How to recharge Homebank e-wallet to repay loan?

- from the card to the Homebank e-wallet number in Halyk

- from the other bank cards to the Homebank e-wallet number

By recharge in ATM:

- select “top up the card”

- enter your Homebank e-wallet number and deposit a desirable amount

By recharge in the payment terminal:

- select functions - “Banking services” - “Top up account / card” - “Top up card”

- then enter the IIN and the number of the Homebank e-wallet

Find out the details of Homebank e-wallet in the Halyk application:

- select “Homebank Wallet” on the main page

- open "Settings" and select "Request"