Your safety –

is our major priority

We would like to draw your attention to the essential requirements set by the National Bank of the Republic of Kazakhstan. In order to ensure the security of your financial transactions, banks are obliged to block access to services in the mobile app, if the following are detected on the customer's device:

∙ Signs of remote control or screen recording.

∙ Violations of operating system security (e.g. root on Android or jailbreak on iOS).

These precautions are necessary because some apps such as TeamViewer, AnyDesk and others can give attackers access to your device and accounts. In addition, screen recording may occur through translator apps with text recognition features.

To keep your data safe and to ensure you continue using Halyk mobile app, we recommend that you disable third-party apps and avoid using devices with a compromised operating system.

On the Internet

- Do not follow the suspicious links of the Internet sources

- Do not tell anyone the SMS code, 3DSecure or password for the Halyk app

- Set up limits and restrictions on the card

- Trust only the Bank’s official pages on social media

On phone

- Do not tell anyone your card data (full card number, expiry date, CVV code, PIN code)

- Do not tell anyone your personal data (full name, IIN, ID number)

- Do not install other third-party programs and applications at the request of strangers

- Do not enter someone else’s mobile phone number at ATM

When paying by card

- Enable push notifications in the Halyk app: section “Menu” > “Profile and Settings” > “Notifications”

- Block your card as soon as you notice the card is missing

- Do not keep the PIN code next to your card

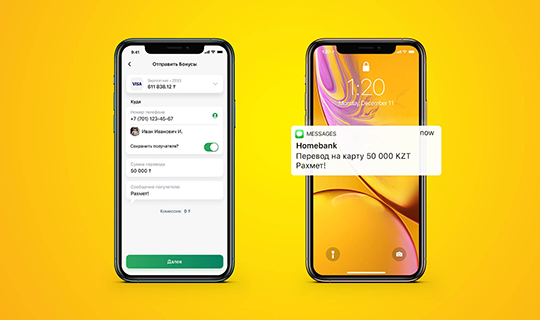

- Pay with your smartphone or by the digital Halyk bonus digital card

Be vigilant — never share your bank card details, account information or digital keys with third parties.

Remember: this can now result in criminal liability.

Who is a “dropper”?

A “dropper” is a person who knowingly or carelessly provides their bank card or account to be used as a transit channel for transferring stolen money.

Most often this happens under the guise of:

• “part-time work” or “cooperation”;

• legal business with the promise of a small reward for transferring or withdrawing funds.

In reality, such schemes are used by:

• fraudsters,

• organizers of pyramid schemes,

• illegal casinos and other shady businesses.

What are the consequences:

• For transferring access to a card, account or digital keys: a fine, restriction of liberty or deprivation of liberty for up to 5 years with confiscation of property.

• For participating in unauthorized transfers: up to 7 years of deprivation of liberty.

How to protect yourself:

1. Never disclose your card details: number, expiration date, CVV/CVC, PIN, passwords, and one-time codes.

2. Do not click on suspicious links in SMS or messengers.

3. Do not install applications at the request of strangers, even if they claim to be bank or police employees.

4. Use complex passwords and update them regularly.

5. Set up and if necessary, adjust transaction limits in your bank app.

Please, follow simple fraud prevention guidelines to protect your money and personal data

REMEMBER!

Do not trust a stranger, even if he introduces himself as a Bank manager.

Employees of Halyk Bank NEVER ask for card details, SMS codes and passwords.

Employees of Halyk Bank do not offer to install other third-party mobile and web applications, except the Halyk app on the official stores Google Play and App Store.

In case of suspicious call, please, do not get into the conversation and inform thereof the Contact Center on phone number 7111.

The Bank informs on ongoing promotions and draws on the official website and profile pages of Halyk Bank in social media.

Do not enter a trusted number/identifier or login, password and the code from SMS intended to enter your profile at homebank.kz at any other web source and/or app.

Do not tell anyone the 3-digit code on back side of the card.

Do not keep the PIN code next to your card.

If you lost your card, please, block it as follows:

- in the Halyk: select the card and go to “Settings”, enable “Temporary blocking”

- through the Contact Center on phone number 7111

You can order a digital card online in the Halyk app and keep using the Bank’s products.

Please, set limits on payments on the Internet in the Halyk app in order to avoid fraud: select a card > “Settings” > section “Card limits” > “Set a limit”.

Employees of Halyk Bank NEVER ask for the customer's personal data – logins/passwords intended to enter your profile, the codes from SMS. In case of disclosure of personal data, fraudsters gain access to your funds.

Do not rush to trust the caller. Please, call the Bank yourself if you receive a suspicious call or message.

Do not go to websites using the banner links or links that you have received in email.

Check, that the connection to the official website is protected with end-to-end encryption (the presence of the https prefix) and the website address (the name of the fraudulent website may differ by only one character, but visually be identical). We recommend you to put the verified website address yourself and add it to your bookmarks. The browser line should contain a link: https://halykbank.kz.

Always double-check the information about drawings and when you are offered to transfer money for a win to your bank account or card.

The Bank never provides the bulk email with attachments, links and forms to enter the Internet banking website.

- The Bank constantly informs its customers on new types of fraud and ways to protect against them

- If fraudulent transactions are detected, the Bank immediately blocks the customer's accounts and cards in order to preserve funds

- In case of identifying fraudulent websites, the Bank applies to the law enforcement authorities to block them

- If you are faced with the fact of fraud, please call the number 7111

Useful Telegram Bots for Protection from Cyber Fraudsters:

- Baiqa Piramida telegram bot allows checking any organization to see if it is included in the lists of unreliable companies.

- Citizen Assistant telegram bot allows “blocking” Internet resources of financial pyramids.

- Fingramota Online app provides a convenient mobile tool for all citizens to interact with the Agency of the Republic of Kazakhstan for Regulation and Development of Financial Market on activities of the regulator and protection of the rights of financial services consumers.