Homebank Installment Plan

Benefits

Term and amount of Installment Plan

- Regular Installment Plan – 3, 6 months

- On-Offer Installment Plan – up to 24 months

- Installment Plan amount – from KZT 4,000 to KZT 2,000,000

How to buy

1. Select the product you like in the partner's store*

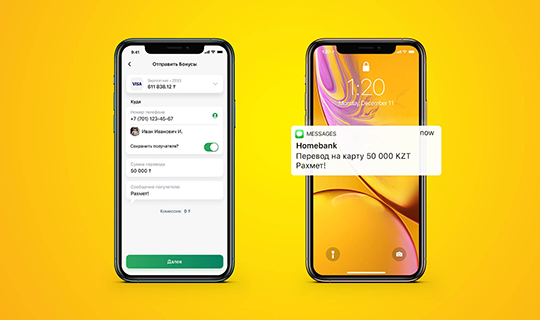

2. Apply for an Installment Plan in Halyk app:

- register in Halyk app

- select Installment Plan section

- enter the amount and select the installment plan period

- confirm receipt of the installment plan

*Click here for the list of partners or in Halyk app.

3. Pay for your purchases by QR at the store checkout

How to repay an installment plan

Pay your Halyk loan on time, or before the due date, to avoid becoming overdue and ruining your credit score. To do this, you need:

- To open Halyk

- To tap Repayment on the main screen

- Select installment plan or loan you want to repay

- Select a card or account for payment and enter the amount to be paid

- Confirm the payment

Attention! Loan repayment in Halyk is available daily from 9.00 a.m. to 7.00 p.m.

The borrower (an individual) shall be liable for non-fulfillment of obligations under the bank loan agreement.

In case the borrower fails to fulfill its obligations under the bank loan agreement, the Bank shall be entitled to, without limitation:

- accrue forfeit (fine, penalty);

- foreclose on the money in the borrower's bank accounts;

- transfer the debt to a collection agency for pre-trial collection and settlement;

- file a lawsuit in court