Digital auto loan

Benefits

Calculate conditions

Payment schedule

| Month | Outstanding principal | Principal payment | Interest payment | Total payment |

| 0 | 0 | 0 |

Conditions

Target group | individuals – citizens of the Republic of Kazakhstan |

| Age of applicant | from 21 to 63 years old at the time of loan repayment |

Car showrooms | Astana Motors, Allur, Orbis, Doscar, Aster auto |

Loan term | 12 to 84 months |

| Interest rate |

|

Loan amount | depending on Applicant’s solvency |

Down payment | from 20%* |

| Collateral | car to be purchased |

Insurance (CASCO and accident insurance) | insurance is made at the expense of the Bank |

* With income verification

** Final calculation of the AERR (annual effective rate of return) is made at the time of loan disbursement in Halyk app

A borrower - individual shall be liable for failure to fulfil obligations under the Bank Loan Agreement. The Bank shall be entitled, if a borrower fails to fulfil obligations under the Bank Loan Agreement, to:

- impose a forfeit (fine, penalty);

- foreclose on funds available on borrower's bank accounts;

- transfer debt for soft collection and pre-trial settlement to collection agency;

- file a lawsuit with a court.

The pledger shall be responsible for the safety and maintenance of the pledged item in proper technical condition, for the risk of accidental loss, damage or forfeiture of the pledged item.

In case the borrower fails to fulfill its obligations under the bank loan agreement, the Bank shall be entitled to foreclose on the pledged property extrajudicially and/or judicially, in accordance with the laws of the Republic of Kazakhstan.

How to apply?

- Visit a car showroom for car registration

- Choose a car

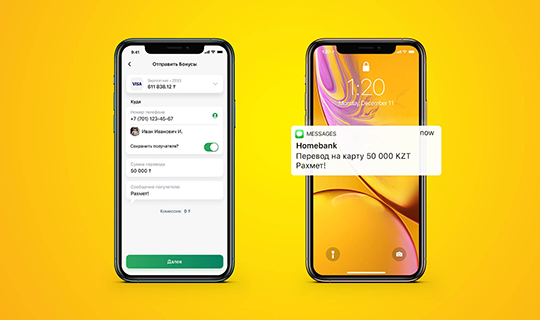

- Register in Halyk app and read the loan decision

- Get a notarized consent online in Halyk

- Enter car license plate number and pay state fee for pledge registration

- Sign documents with EDS

- Pledge will be registered online

- Done! Car is already in your possession!