7-20-25 Housing Mortgage Lending Program

Benefits

Terms

Loan purpose | acquisition of housing with a mortgage on the primary market |

Interest rate | 7% (AEIR – 7.2%) |

Maximum cost of housing | KZT 30,000,000 - for Astana, Almaty, (including suburban areas), Aktau, Atyrau, and Shymkent KZT 25,000,000 - for Karaganda KZT 20,000,000 - for other regions |

Down payment | at least, 20% of the cost of housing |

Security | the acquired housing |

Proof of income | mandatory |

Fees | 0 tenge |

Borrower requirements* | - citizenship of the Republic of Kazakhstan (including suburban areas) - no housing on the right of ownership (spouse) during the last 18 (eighteen) months in the territory of the Republic of Kazakhstan - no outstanding mortgage housing loans - purchase of primary housing only ** (no restrictions on the Residential Complex) - the pledger can only be the borrower - one borrower may receive a loan only once |

* The Operator of Kazakhstan Sustainability Fund JSC allocates the limit

**A residential property for which the title is registered for the first time when it is purchased from a developer (customer) or other legal entity selling housing from a developer (customer)

*** Consider when calculating in a loan calculator

A borrower - individual shall be liable for failure to fulfil obligations under the Bank Loan Agreement.

The Bank shall be entitled, if a borrower fails to fulfil obligations under the Bank Loan Agreement, to:

- impose a forfeit (fine, penalty);

- foreclose on funds available on borrower's bank accounts;

- transfer debt for soft collection and pre-trial settlement to collection agency;

- file a lawsuit with a court.

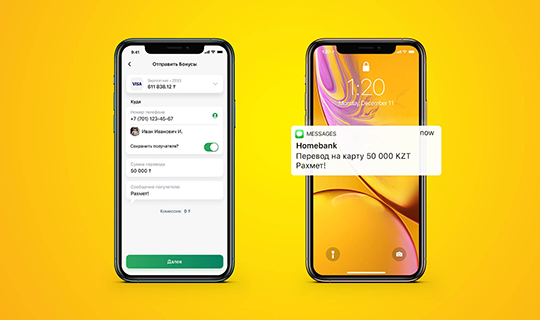

How to apply

Visit the Bank's outlet (subject to availability of limit*)

Get the Bank's decision

Collect a set of documents for further financing