Refinancing

The best conditions

Refinancing terms

| Interest rate | 17.5% to 38% (AEIR of 28.8% to 45.3%) |

| Refinancing at the customer’s discretion |

|

| Maximum amount of a refinanced loan | 8,000,000 tenge |

| Term | up to 5 years |

| Partial and full early repayment | without fees in the Halyk app |

How to refinance a loan online

1. In the Halyk mobile app: Home screen > “Loans” > “Refinancing” > “Open”

2. In the application form specify the amount of money you want to borrow over an amount you need to refinance loans issued by Halyk Bank or other banks

3. From the offered list of loans, you need to select the loans that you want to refinance. The amount to refinance loans will be added to the amount specified in the application form

4. Read the decision on your application and select a card for crediting funds

5. Read the loan documentation and sign the documents using EDS issued by the Bank

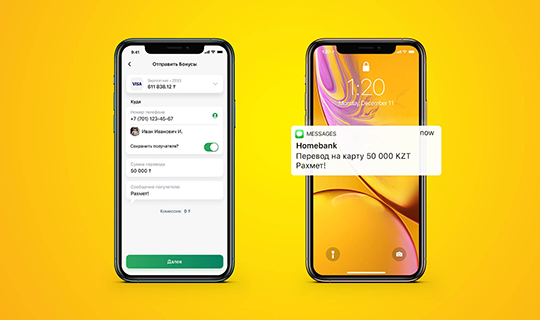

6. Confirm refinancing with the code from SMS

7. Upon approval of a refinancing loan:

- the amount that is not intended to refinance loans of Halyk Bank, will be credited to the card that you have specified

- loans issued by Halyk Bank will be repaid automatically

- borrowings for repayment of loans issued by other banks, will be credited to the card that you have specified. You need to repay loans on your own, by transferring borrowed funds for full early loan repayment

8. The borrower (an individual) shall be liable for non-fulfillment of obligations under the bank loan agreement.

In case the borrower fails to fulfill its obligations under the bank loan agreement, the Bank shall be entitled to, without limitation:

- accruе forfeit (fine, penalty);

- foreclose on the money in the borrower's bank accounts;

- transfer the debt to a collection agency for pre-trial collection and settlement;

- file a lawsuit in court