Western Union Online

Benefits

How to make a transfer

Terms

| Sending footprint | over 200 world’s countries and territories |

| Currency of transfer | KZT/USD |

| Transfer speed | in a few minutes* |

| Halyk tariff | 0.5% of transfer amount (min 1USD/ 380 KZT) |

Tariffs for sending Western Union money transfers

* Depends on agent hours in a payout country and local laws.

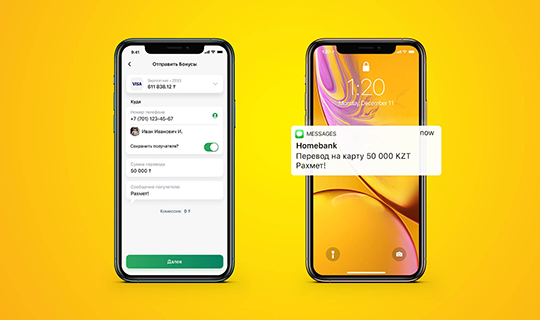

Send and receive the transfer

SEND THE TRANSFER

1. Go to the Halyk portal

2. In the "Transfers" section, select the “Western Union” section > Send the Transfer

3. Fill out the electronic form

4. Check the data and read the terms of transfer

5. Enter the SMS code sent to the trusted phone number

6. Money transfer control number (MTCN) will be available in the transfer application, which can be printed in the Transfer Archive, it will be sent as an SMS to the customer’s trusted phone number

RECEIVE THE TRANSFER

1. Go to the Halyk portal

2. In the "Transfers" section, select the “Western Union” section > Receive the Transfer

3. Fill out the electronic form

4. Check the data and read the terms of transfer

5. Confirm receipt of transfer by SMS code

6. The amount will be credited instantly to the specified account

SEND THE TRANSFER

To send a transfer, you need to contact the Halyk branch from the list below and provide the following documents:

For residents

• identity document

Required information:

• Recipient’s name

• Amount of transfer

• Currency of transfer and country of the transfer destination

For non-residents

A document certifying registration with the authorized bodies of the Republic of Kazakhstan, the rights of entry, exit and stay of a non-resident person in the Republic of Kazakhstan, unless otherwise provided by international treaties ratified by the Republic of Kazakhstan (migration card, if the Customer does not have it, another document certifying registration stipulated by the current legislation of the Republic of Kazakhstan)**.

** It is required only when sending / receiving transfers in an amount exceeding 2,000,000 tenge, or in an amount in foreign currency exceeding the equivalent of 2,000,000 tenge, including by making several transfer operations (transactions) in one calendar day by the Customer without account opening

RECEIVE THE TRANSFER

To receive a transfer, you need to contact the Halyk Bank branch, provide an identification document, and know:

• Money Transfer Control Number (10-digit code)

• Sender’s name

• Amount of transfer

• Currency of transfer and sender’s country

Remember: the recipient does not pay a fee for receiving a transfer.

Important to know

* In accordance with the terms of the service, the payment of transfers may be delayed or services may not be available due to the specific nature of the provision of services, including the specific amount of the transfer, country of destination, availability of currency, applicable law, identification requirements, opening hours of the payment outlet, time difference between time zones, tariff terms with deferred payment of a transfer, or other applicable restrictions. See more details in Money Transfer Application.

** Information on the number of branches as of 30 June 2016.

*** In addition to the fee for sending a transfer, Western Union can receive foreign exchange gains if the currency of payment differs from the currency of sending the transfer. When choosing a transfer system, pay attention both to the fee and the exchange rate of the operation. The transfer fee and exchange rate may vary depending on the transfer system, channel and branch where the service is provided, subject to a number of factors. Fees and rates may change without notice

Dear customers of Halyk, in order to prevent fraudulent money transfer operations, we ask you to follow a few simple security measures:

1. When making transfers, do not disclose the transfer details to third parties (both partial and complete details, including the transfer number).

2. Be careful during the transfer execution, make sure that no one can bug / spy on the transfer details, as fraudsters can forge documents to receive the transfer using this information. Keep the transfer details out of the reach of third parties.

3. Avoid sending transfers to strangers. Remember that in this case you may be a victim of fraud. Send money to those you know and trust.

4. If you receive a request from a stranger to provide a copy of the application for sending a transfer or other information about the transfer operation, immediately stop communicating with such person, as this is probably an attempted fraud. Under no circumstances can money transfers be used as evidence of solvency.

5. Do not send money transfers long before receiving, for example, when planning a trip abroad. Money transfer services allow you to receive a transfer within 10-15 minutes.

6. Do not respond to calls / e-mails / SMS received by you on behalf of the Bank about the need to send / receive a transfer. The Bank does not call customers and does not send messages / SMS about sending / receiving a transfer.

7. Do not respond to calls / e-mails / SMS telling that you have won the lottery / prize and so you need to send a certain amount of money for registration, payment of taxes, customs fees, etc.