Consumer loan

Benefits

Conditions

| Term of the loan* | 6 – 120 months |

| Loan currency | tenge |

| Interest rate (with fee)** | Up to 23 months: interest rate of 20% to 21,5% (AEIR 24,8% to 35%***) Up 24 to 120 months: interest rate of 23,5% to 25% (AEIR 27% to 35%***) |

| Interest rate (with no-fee) | Up to 120 months: interest rate of 28.5% to 30% (HESA from 32.2 to 35%***) |

| Loan amount | depending on the Applicant's solvency |

| Collateral | commercial |

| Documentary proof of income | documentary proof of income is required, if collateral value covers 60% and more of the loan amount |

| Insurance | is carried out by the Bank |

| Fees*** | for loan arrangement – 2% from loan amount + 20 000 tenge |

*Except loans, the intended use of which should be carried out according to the Regulation of the Management Board of the Agency for Regulation and Supervision of Financial Market and Financial Organizations of the Republic of Kazakhstan No.49 dated 23 February 2007 “On Approval of Rules for Lending Documentation

**Term and amount of the loan subject to the terms determined by the Bank for this product

***Programme retail lending "no commission" is not provided

The borrower (an individual) shall be liable for non-fulfillment of obligations under the bank loan agreement.

In case the borrower fails to fulfill its obligations under the bank loan agreement, the Bank shall be entitled to, without limitation:

- accruе forfeit (fine, penalty);

- foreclose on the money in the borrower's bank accounts;

- transfer the debt to a collection agency for pre-trial collection and settlement;

- file a lawsuit in court.

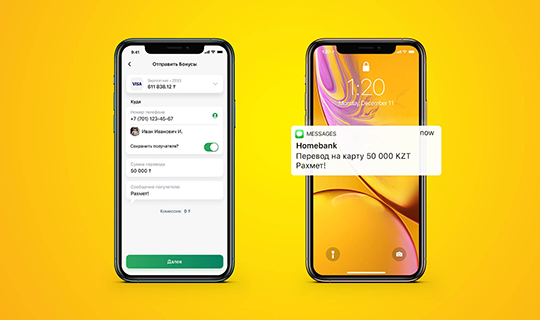

How to apply

Submit an application on the website, at any branch of the bank, or by number 7111

The Bank specialists will make all preliminary calculations and report the approved amount

Visit the bank's branch to get the approved amount