Self-employment

Who is self-employed?

Self-employed is someone who works for themselves and officially pays taxes under a simplified tax system.

Self-employed is someone who works for themselves and officially pays social payments and fees. From 1 January, 2026, you can choose a special tax regime for self-employed individuals and work legally, without the need for an individual entrepreneur or complex reporting.

In this section, we'll explain what you need to do to account properly your income and pay social payments and fees on time.

Who is eligible for self-employed status?

You can be self-employed if:

• You are a citizen of the Republic of Kazakhstan or a Kandas (Kandas is an ethnic Kazakh who was not previously a citizen of the Republic of Kazakhstan and who has received the corresponding status in accordance with the procedure established by the authorized body for population migration issues. Law of the Republic of Kazakhstan "On Migration of the Population").

• You work alone, without hired employees

• Your income is up to 300 MCI per month (approximately KZT 1,297,500)

• You are engaged in a type of activity that is permitted for self-employed individuals (the list is approved by the Government of the Republic of Kazakhstan)

What should a self-employed person do?

1. Take your income into account

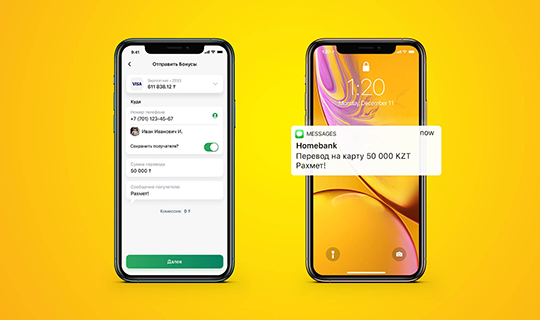

• Install Halyk Super App and open a self-employed card

• Record every income you receive using a receipt in the Halyk Super App app

• all receipts is saved automatically In one list (registry)

You don’t need to keep notebooks or tables – the application will do everything itself.

2. Pay only the social paymentsand fees you need

• Personal Income Tax (PIT) – 0%, no need to pay

Social payments – 4% of income

• Compulsory Pension Contributions – 1%

• Social contributions (SC) – 1%

• Compulsory Health Insurance – 1%

• Employer’s Compulsory Pension Contributions – 1%

The payment deadline is no later than the 25th of the following month.

3. Monitor the type of activity

• The activity should be on the list of permitted activities for the self-employed

• If you start another type of activity, your income will exceed 300 MCI or hire employees — you need to switch to a different tax regime

4. How can a self-employed person open and use an account and card?

A self-employed person is an individual, not an individual entrepreneur.

Self-employed person's account and card:

• open a self-employed in the Halyk Super App

• no need to notify the State Revenue Committee about the opening

• the cardcan be used for self-employedtransactions and create receipts in the Halyk Super App

5. Transition period: January–February 2026.

You're already working as an IE. What should you do to become self-employed?

Answer:

• Close your IE

• Open a self-employed account in the Halyk app Super App

• After your first check, you will receive the status of self-employed

6. You have other income that doesn't qualify for self-employment. What should you do?

• You can choose another special tax regime

• Or switch to the regular taxation system, as specified in the Tax Code of the Republic of Kazakhstan

7. Should I stop my business if I have no income?

• No, it is not required

• Tax authorities will deregister you automatically if there is no income (article 716-13 of the Tax Code of the Republic of Kazakhstan)

Tips for the self-employed • Install the

Halyk Super App immediately after starting work

• Keep track of your income daily • Don't put off paying social payments and fees until the last day

FAQ

An individual without employees, with an income of up to 300 MCI (KZT 1,297,500) per month and a permitted type of activity.

No. A self-employed person is an individual , not an IE.

No, registration as an individual entrepreneur is not required.

Via Halyk Super App - each income is recorded and automatically generated in the register.

Personal Income Tax (PIT) – 0%, no need to pay

Social payments – 4% of income

Compulsory Pension Contributions – 1% (max. KZT 425,000)

Social contributions (SC) – 1% (max. KZT 29 750)

Compulsory Health Insurance – 1% (max. KZT 102 000)

Employer’s Compulsory Pension Contributions – 1% (max. KZT 148,750)

Before the 25th day of the month following the reporting month.

A special account for self-employed individuals with the right to conduct self-employed operations.

Yes, all transactions related to business activities are permitted on this account.

If you are an active IE, you should close your IE, open a self-employed account in Halyk Super App, and after receiving your first paycheck, you will be granted self-employed status.

No. Statuses cannot be combined.

No. When hiring employees, you need to change your tax regime.

Switch to a different tax regime.

No. Only activities from the approved list.

Select another special regime or switch to the general tax regime.

No. Tax returns are not required—only income accounting and payment of taxes.

No. If there is no income, the tax authority will automatically deregister you.

Keep records daily, pay taxes on time and do not exceed the regime terms and conditions.

The "Receipts" section is a service for generating checks.

A receipt can be generated in the app for an individual, a legal entity, or an individual entrepreneur by specifying the service/product in the list.

You can also share a PDF version of the receipt and send it to the customer via any mobile messenger (WhatsApp, Telegram, email)

The entire receipt history, receipt search, and income accounting are displayed in one section: Receipts.

A receipt can be cancelled within 14 days (from the receipt issue date) in case of cancellation/return of goods, or if the receipt was generated in error.