Primary housing from BAZIS-A

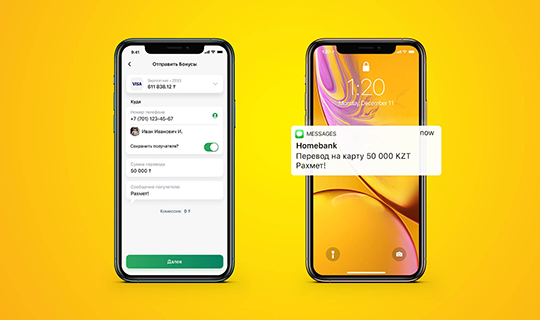

Mortgage for purchase of housing under construction. You can get a solution within 5 minutes in Halyk app without leaving your home

This product participates in the “Gift Marathon” promotion

When you apply for a loan, you automatically become a participant in the weekly prize draw and the grand prize draw.

Benefits

down payment of at least 20%

without additional collateral

primary housing

| Borrower requirements |

|

| Period of loan | from 6 months to 240 months |

| Down payment | at least 20% of the cost of housing |

| Security | against the acquired housing |

| Interest rate (with fee) | from 19% to 21% (AEIR from 21% to 25%)* |

| Interest rate (with no-fee) | from 21% to 23% (AEIR from 23.1% to 25%)* |

The Bank reserves the right to request additional documents

* Term and amount of the loan subject to the terms determined by the Bank for this product

A borrower - individual shall be liable for failure to fulfil obligations under the Bank Loan Agreement.

The Bank shall be entitled, if a borrower fails to fulfil obligations under the Bank Loan Agreement, to:

- impose a forfeit (fine, penalty);

- foreclose on funds available on borrower's bank accounts;

- transfer debt for soft collection and pre-trial settlement to collection agency;

- file a lawsuit with a court.

| Application processing | 0% |

| Origination | 1% of the loan amount |

| Crediting to account | 0% |

| Partial or full early repayment of the loan |

|

| Collateral insurance | at the expense of the Bank (after commissioning of the facility) |

| Personal insurance | upon the borrower's consent (at the borrower's own expense) |

How to apply

1

Apply in Halyk app

2

Fill in the application form and select a residential complex

3

Get the Bank's decision