Promotions

Digital car lending promotions

Apply for car loan at reduced interest rates in car dealers of Halyk partners!

Halyk Bank JSC together with its car dealer partners take care of your budget and offers you to apply for car loan at reduced interest rates from 0.1% to 21.3% per annum (Annual Effective Rate of Return from 0.1% to 23.5%) for the most popular vehicle brands. Loan rate depends on brand and model of the vehicle, chosen lending period and amount of down payment.

Loan period: from 12 to 84 months

Loan amount: from KZT 1,500,000 to 30,000,000

Age of applicant: from 21 to 63 years old at the time of loan repayment

Down payment: from 20%

Loan application under promotion is available only for new vehicles.

Promotion's period is limited.

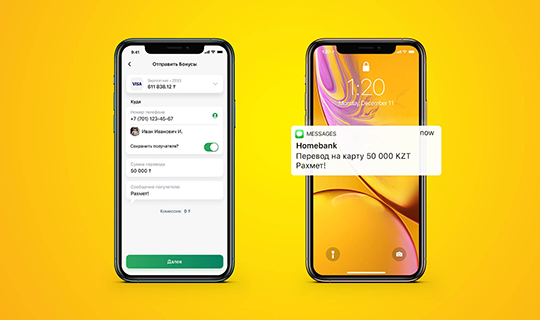

Online car loan application in Halyk app.

CASCO from Halyk for the whole period of loan.

Promotion is valid for the following vehicle brands:

How to apply?

- Go to car dealer to apply for car loan

- Choose car

- Register in Halyk app and read the Bank's decision

- Enter car's license plate number and pay state fee to register the pledge

- Sign documents with EDS

- Pledge will be registered online

- Done! You have your car!

Borrower - individual is responsible for non-fulfilment of obligations under bank loan agreement

If borrower fails to fulfil obligations under Bank Loan Agreement, the Bank is entitled, including:

- forfeit (fine, penalty) imposition;

- foreclosure of money in borrower's bank accounts;

- transferring debt to collection agency for pre-trial collecting and settlement;

- taking legal action.

Pledger is responsible for safety and maintenance of pledged item in proper technical condition, for risk of accidental destruction/destruction, for damage and loss of pledged item.

If a borrower fails to fulfil obligations under bank loan agreement, the Bank is entitled to foreclose on pledged property out-of-court and/or in court, according to the legislation of the Republic of Kazakhstan.

The Bank retains the right to unilaterally change terms and conditions of promotion, including suspension or extension of promotion period without notifying customers.